Ira Deposit Limit 2025. Beginning in 2025, the ira contribution limit is increased to $6,500 ($7,500 for individuals age 50 or older) from $6,000 ($7,000 for individuals age 50 or older). You can contribute to an ira at any age.

Beginning in 2025, the ira contribution limit is increased to $6,500 ($7,500 for individuals age 50 or older) from $6,000 ($7,000 for individuals age 50 or older). Your personal roth ira contribution limit, or eligibility to.

IRA Contribution Limit Visual.ly, The maximum ira contribution is $7,000 in 2025 ($8,000 if age 50+). The ira contribution limit for 2025 is $7,000.

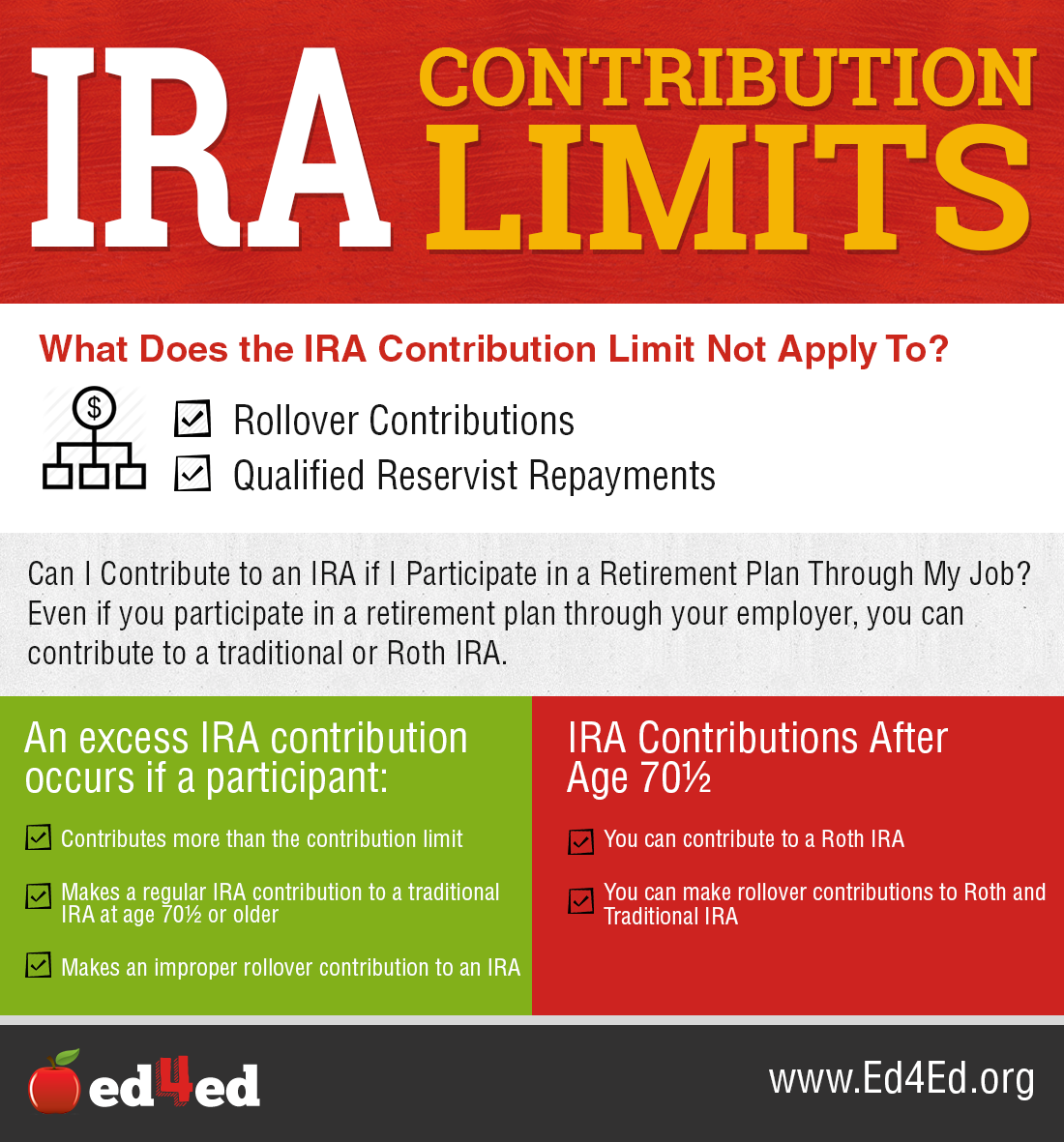

IRA Contribution Limit the.Ismaili, Rollovers are also subject to the roth ira. Find out using our ira contribution limits calculator.

IRA Contribution Limit The.Ismaili, For 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 or older. If you have a traditional ira, a roth ira―or both―the maximum combined amount you may contribute annually across all your iras.

IRA Contribution Limits **Understanding Annual Contribution Limits for, You can contribute to an ira at any age. Beginning in 2025, the annual total contribution limits to an ira will be raised to $10,000 for taxpayers between the ages of 60 and 63;

2025 Sep Ira Contribution Limits Irs Melly Sonnnie, The limit for contributions to traditional and roth iras for 2025 is $7,000, plus an additional $1,000 if the taxpayer is age 50 or older. The maximum ira contribution is $7,000 in 2025 ($8,000 if age 50+).

The Benefits Of A Backdoor Roth IRA Financial Samurai, The ira limit's evolution from creation in 1974 until 2025. If you're age 50 or older, you're eligible for extra contributions as well.

Roth Ira Contribution Limits Calendar Year Denys Felisha, Plus, find out whether you'll be able to deduct these from your taxes this year. The ira contribution limit for 2025 is $7,000.

IRA Contribution Limits 2025 Millennial Investor, The ira contribution limit for 2025 is $7,000. The maximum total annual contribution for all your iras combined is:

Contribution Limits 2025 Ira Kaye Savina, The ira contribution limit for 2025 is $7,000. For 2025, taxpayers began making contributions toward that tax year’s limit as of jan.

2025 Max Ira Contribution Limits Over 50 Jaymee Faustine, Your personal roth ira contribution limit, or eligibility to. The maximum ira contribution is $7,000 in 2025 ($8,000 if age 50+).

The limit for contributions to traditional and roth iras for 2025 is $7,000, plus an additional $1,000 if the taxpayer is age 50 or older.